Is the economy improving or are we just “muddling through”? Over the last year I’ve tried to note what we should look as reams of economic data are released and then spun by an eager, if naïve press. It’s time to go back and review what’s happening now that data for the end of 2010 is starting to come in.

Headline unemployment appears to have dropped as we enter the new year, but it’s best to ignore that particular stat. This figure does not count “discouraged workers”, which is to say those that have been unemployed so long that they are too busy scratching out what they can to look for a regular, permanent job. As I predicted at the start of this month headline unemployment will continue to drop for this reason, meaning that any real job growth will be hidden.

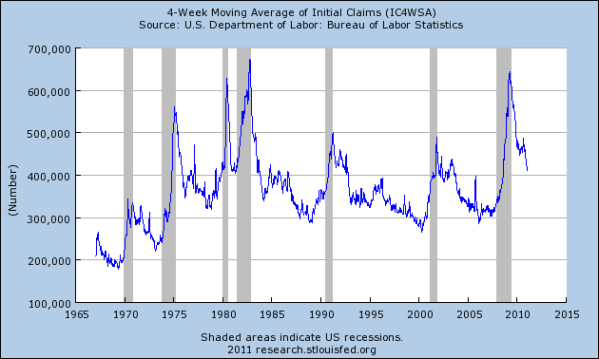

Six months ago I suggested watching the more visceral 4-week moving average of initial unemployment claims, waiting for it to move below 450k per week. It just managed to do that at the end of 2010, which is to say that the beginnings of job growth are upon us. This chart is from the St Louis Federal Reserve:

Is this the start of something bigger? Note that initial claims are still about where they were at the worst part of the last two recessions, meaning that we can’t expect much yet. On January 28th we will have the first estimate of GDP growth for the 4th quarter of 2010, which remember has to be above 3.3% before we can expect job growth. Third Quarter was an anemic 2.6%. The end of the year should be quite a bit higher than that, possibly as high as 3.6%, which would be very good news.

Is this the start of something bigger? Note that initial claims are still about where they were at the worst part of the last two recessions, meaning that we can’t expect much yet. On January 28th we will have the first estimate of GDP growth for the 4th quarter of 2010, which remember has to be above 3.3% before we can expect job growth. Third Quarter was an anemic 2.6%. The end of the year should be quite a bit higher than that, possibly as high as 3.6%, which would be very good news.

But is it sustainable through 2011? It’s very hard to tell. GDP growth through the next year could be between 3% and 4%, meaning we could yet see some significant job growth. This is based on the latest stimulus in the form of tax cuts, which are untested. But the 4-week Initial Claims number remains the best quick indicator we have.

Is there any real sign of Deflation, following the guide that I published earlier? So far there is not – and increases in gasoline prices continue to make everyone wary of inflation instead. I’m starting to think that we will avoid any serious deflationary trap because of rising commodity prices, especially for fuel. That will help tame our consumption, but it won’t feel good.

Lastly, I suggested that we all keep an eye on credit markets as some easing of credit has to occur. My hunch is that there will be more political pressure to increase lending, although not in the housing market. Dramatic steps such as “Quantitative Easing” have not helped that situation (and may have even hurt it) with bank reserves essentially unchanged – and still waiting for an opportunity that looks like an investment. This is probably the most important thing to watch for if we are going to see a genuine reversal in the economy for the better.

So what has happened in the last six months to change the situation? Not anywhere near enough, but the same things are worth watching for any signs that the economy is improving or getting worse. Initial claims are best for the optimists among us and falling consumer prices would be a signal that the pessimists are winning. Much of the rest of it will be noise, except for the all-important GDP figures – which are so slow to come out that they only confirm what we already know. This all could change if somehow Washington manages to do something dramatic, but don’t count on it.

As always, fasten your seatbelts.

I can see where the term ‘muddling through’ comes in. There really is no change in anything, is there. That does explain QE2 and the latest stimulus.

You should let us know if you see signs of a real panic at the top. The powers that be can’t be happy with the way things are going.

I’ll let you know if I see any more panic, you can be sure of that. I can’t help but wonder about the latest tax cut / stimulus, but I think it’s the last we’ll see for a bit.

I should do an update on the Quantitative Easing, because it hasn’t worked out as planned. I thought it would help at least some, but it may have actually made things worse.

Read an article yesterday in Salon or Slate where they claimed that the European countries including Canada were doing a much better at job creation.

Dan, I’m sure that’s true. We have been infatuated with keeping banks full of money (that they don’t lend out) and tax cuts, neither of which seems to generate jobs all that efficiently. Was just in a discussion on twitter with Jack, and I think that there has to be some way the government can do *some* good, even if it’s limited and/or only for dire emergencies (which, as you know, I tend to think this is).

I mentioned the “multiplier effect” here:

https://erikhare.wordpress.com/2010/09/29/what-happened/

That’s the old idea that every $1.00 the government spends generates $1.50 in GDP. The reason this isn’t worth talking about too much is that it’s pretty clear that, based on what we’ve seen, the multiplier isn’t 1.5X but about zero. But … that may only be true because we though we could spend money on anything and have the same multiplier, but that seems like a pretty lazy assumption to make.

I’ll stay on it. The two ideas I have so far are buying off the Boomers and reducing employee overhead. I’ll bet there are more, possibly even a CCC or WPA type project (though times may have changed on those).

Anyone else have any ideas?

This was also in today’s NYT business section. Both articles say it comes down to the lack of union power in the US. One interesting new tidbit from the NYT is that this recession is almost entirely on the backs of the unemployed. Also read a rather lengthy great article in the Guardian called UK 2015, there was also another one where a politician talks about continuing to work on lowering child poverty by aiming at some middle class and elderly entitlements. Apparently many UK children (1:4?) live in poverty and many have a working parent.

Oh and another one. PBS newshour showed a clip where s Shriver talked about the war on poverty (which he headed) and how tiny their budget was compared to the Vietnam War.

Last week the Minnesota GOP announced their plans to cut corporate income tax. This morning the Pioneer Press headlines reveal plans to CUT 5000 state jobs. Once again right wing ideology trumps the welfare of the state of Minnesota.

Just read another interesting medical/economic report in the New Yorker Jan. 24th. Also very pertinent as it covers Camden NJ where they just laid off 1/2 of their police force. ” A recent report on more than a decade of education reform spending details a story found in every state. In Massachusetts nearly a billion dollars were sent to school districts to finance smaller class sizes and better pay. For every dollar added to school budgets the cost of maintaining teacher health benefits took a dollar and forty cents”

It states “No community anywhere has lowered its health-care costs by improving their medical services. Only by cutting or rationing them. To many people, the problem of health-care costs is best encapsulated in basic third grade math lesson, you can’t have it all. You want higher wages, lower taxes, less debt? Then cut health-care services.” Just so you don’t think I am sending you to a bleak house the article is actually optimistic.

Pingback: Pledge Drive! | Barataria – The work of Erik Hare

Pingback: State of Jobs | Barataria – The work of Erik Hare

Pingback: Four Years On | Barataria – The work of Erik Hare

Pingback: Churn & Burn | Barataria – The work of Erik Hare

Pingback: Inflation and “Real” | Barataria – The work of Erik Hare

Pingback: Waiting for the “Go” | Barataria – The work of Erik Hare

Pingback: Summertime Blues | Barataria – The work of Erik Hare

Pingback: Another Pledge Drive! | Barataria – The work of Erik Hare