Will the economy produce a lot more jobs in 2012, or are we stalled looking at permanent unemployment and a new underclass? It’s an important question because the answer to it predicts the course of the election season far more than anything else. It’s the economy, stupid – really it’s the jobs. Nothing else is likely to matter as President Obama makes the case for his own re-election – and likely runs against Congressional paralysis in the process.

If we want to predict tomorrow’s news today, there is nothing more important than what might happen with employment. While we can never be sure exactly what will happen, we can put boundaries on the possibilities.

There is no doubt that there has been rather weak but somewhat consistent job growth in 2011, as news organizations like CNN are starting to pick up on. If it continues more or less as it has been, Obama should end his first term with no net loss in jobs and an unemployment rate right about the 7.8% he had at the start. Analysts are quick to point out that no President has been re-elected with an unemployment rate higher than 7.2% since FDR, which is to say since the last Depression. A big part of how the public reads this job growth we’ve had so far is how much people believe that we are in the middle of another Depression, or something at least like it, which demands a bit of patience.

Why isn’t job growth stronger? As noted before, it’s already running a bit ahead of economic growth in typical postwar terms, so it’s hard to say that job creation isn’t about as strong as anyone can expect.

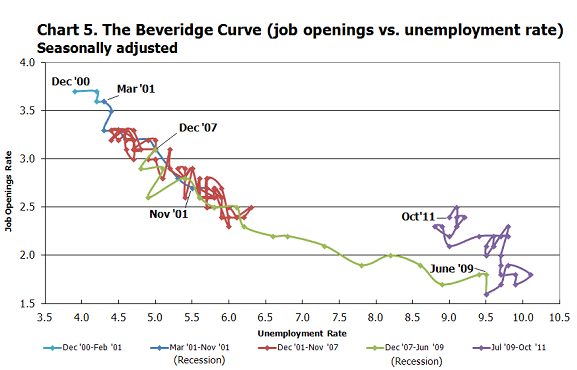

One reason that has been suggested by many people is “Structural Unemployment”, or a lack of potential employees with the right skills for today’s jobs. This argument is quietly based on the principle of restructuring, which is to say that the economy is changing rapidly and people have to learn how to cope with the new one. Structural Unemployment, however, is not likely a major problem. The graph below, called a “Beveridge Curve” after it’s inventor Henry Beveridge, relates job openings to unemployment:

If the problem at hand was one of a lack of the right skills, this curve would shift upward as more job openings produced little to no change in unemployment. This does happen in 2011, but only slightly. A paper by the San Francisco Federal Reserve (pdf link) from last October estimates that skills mis-match does account for about 1% of unemployment, or about 1.3M unemployed. The effect is there, but it’s not huge – the problem is mainly one of lack of demand.

It’s that simple. There is no magic re-training or other program that will get us out of this situation. What counts is increased demand for workers, which is always fueled by growth.

Without economic growth picking up in 2012, it’s hard to see demand changing substantially for workers. Yet there does appear to be just enough pent-up demand from the lack of hiring over the last decade to keep things moving along into the next year.

The key number is 1.6M – that’s the number of jobs that have to be created by about October for Obama to break even. Call it around 160k per month and we know what to look for. It’s worth noting that we’ve been running 200k jobs per month, so it’s entirely possible that this could be pulled out at the last minute.

I still think it’s fake because it’s an election year. Now you’re telling us that this might be a buzzer-beater? I remain skeptical. But I will keep an open mind.

Jim, I was slow to accept the new job growth for a lot of reasons, but it does appear to be real and ongoing. Yes, the timing is pretty strange but there’s always the chance we’ll greatly exceed the 1.6M and it won’t be a buzzer-beater (good term!) heading into the election.

Jim, it’s real. I think Erik is onto something with the pent-up demand argument but it may be easier to say that it had to turn around eventually. It’s not like everything totally stopped in 2008 because we didn’t go into a full depression. I am not sold on the idea that there is restructuring but the 1.3 million jobs unfilled sort of implies it.

I think it is good to know what to watch for in 2012. We can judge if it is real as we go.

Anna, I think you have it here. This had to come sometime – and it’s not as though it is so strong that it really does look like someone is goosing things. We still don’t know exactly where the new jobs are coming from, but they appear to be under SIC category “Professional and Managerial” predominantly – which is to say that people are forming consultancy and service companies. This only makes sense since their benefits are running out or they are young and never had any – people have to eat. Jobs had to be created somehow eventually just for that reason.

Rather than just say it’s real, as I have, I think it makes sense to offer an experiment that says, “Here is how you can be sure it is real as we go forward”. That’s about all any of us can do, IMHO.

Sorry, Erik and Annalise, but I have to agree with Jim. The coincidence of the numbers going this way, heading into a re-election year, is just too much for me to swallow. I will always remain optimistic in hopes that our economy rebounds and shows some real strength again – but there are simply WAY too many other factors that cannot be ignored. It just seems like a more likely scenario will unfold whereby political and economic ‘spin’ will be implemented by our illustrious leaders to keep the 1% big dogs firmly in control and always lining their pockets at the expense of the 99%.

I understand. If someone had said in August, “Relax, it’ll look OK by January” I would not have believed them. It’s not exciting job growth, but it’s something. The economy itself is still very weak and could see a reversal from any one of a number of external factors – the most obvious coming from Europe, but we can’t ignore a home-grown meltdown like JP Morgan being heavily implicated in the MF Global debacle (I almost wrote about this today – but give it another week to unfold some more).

Should you be skeptical? I don’t blame you at all. I’m looking for reasons why this could be turning around because it seems to be adding up. But it is always worth keeping your eyes open at the very least. I’m laying out just what would have to happen for us to get ‘er back to even before the election – and believably so.

We’ll see.

I am skeptical as well but I do see people getting jobs so I do not know what to think. Annalise may have said it best that it had to turn around eventually. But Randy is also right that we have every reason to believe that they will lie cheat and steal whatever it takes to stay in power and that includes both parties. We have to wait and see but I want more proof before I believe anything is real.

That seems fair. What convinced me that it had to be real was when ADP (a private payroll processing company) consistently verified the numbers from BLS. They weren’t all that close at the start of 2011, and both were scrambling to find out why. We then had revisions up for the first time since the start of the Depression. That says to me that they had trouble finding the new jobs, which is just what we would expect in a major restructuring. So between the independent verification, the scramble to conform, and the small but real skill gap I think we are seeing what we should expect when the foundation of an actual recovery is finally in place.

Note that I’m not calling this a real “recovery” in the Postwar Post-Recession sense at all. This is different.

I think you are a little too optimistic here. But the graph is really great. Remember again most people get their news from less than ideal sources on the television and radio plus. I am firmly in the Krugman camp and most people never read him. As always simplify every other economic posting should be non-wonkish but still good/true.

I guess I don’t necessarily want to sound optimistic, but rather lay out the terms for while we see not only that this is real (ie, it continues at least as strong) as well as what’s likely to be the political patter in the coming year. I know, people don’t get their economic news from sources that are willing to describe this in terms outside of what they already know, so they are terribly crippled when it comes to unusual (not new!) situations like this.

I’m not a fan of Krugman, but only because I think there are big investments the Feds can make in both jobs and, especially, restructuring – but we can also throw away a lot of money if we’re not careful. I’m not a fan of simple stimulus for the sake of it, but instead carefully designed efforts and easing the restructuring that has been allowed to languish for a solid decade. This may seem like a quibble, and outside the Left it probably is, but I think it’s very important.

forgot a comma after simplify sorry

Also please elaborate more on your fist sentence. Also I think this election will come down to a few counties in Ohio and perhaps the lower rocky mountain states of Colorado and New Mexico.

Geographically you’re certainly right. The deal in Ohio is more than just jobs – it could well be retraining and/or the return of the manufacturing jobs they lost. I dug out data on Ohio specifically at the St Louis Fed, and their job loss has been hugely in manufacturing:

https://research.stlouisfed.org/fred2/graph/?graph_id=53254&category_id=0

(I save the graphs I like, what can I say?)

They lost 500k jobs total since 2001, never really gaining anything back between the two official “recessions” of 2001 and 2008. 370k of them were in manufacturing alone! This explains why they switch parties so often – they keep voting against whoever is in power. What makes them a swing state is that they got hammered and aren’t making the ground back at all.

The mild upswing in 2011 will have to accelerate before Ohio will feel comfortable, I’m sure, so I would say that if you want to see the Buckeye state feel good about Obama you should look for about 300k jobs there in the next 10 months – ideally in manufacturing.

Pingback: Gingrich? Really? | Barataria – The work of Erik Hare

Pingback: Negative Interest | Barataria – The work of Erik Hare

Pingback: Back to Even | Barataria – The work of Erik Hare

Pingback: The Small Story of 2012 | Barataria – The work of Erik Hare