Data comes in from an amazing variety of sources telling us just what is up or down in the economy. If it can be measured, it probably is. You want jobs information? There’s information on unemployment, job creation, job destruction, hours worked … just about whatever you want. Deciding what is useful is always the hard part – and that is the great skill any of us have to develop in this information age.

A year ago Barataria was focused on Unemployment Initial Claims as a good proxy for total job growth figures that would come out later in the month. It worked for a while because in 2010 through the summer of 2011 we were at or near the bottom of job creation, picking up steam very slowly. This figure stopped being a good indicator for reasons that suggest large employers are still laying off people (those who are eligible for unemployment benefits) while small companies are hiring.

But it would be wrong to drop our study of Initial Claims completely, so let’s take another look.

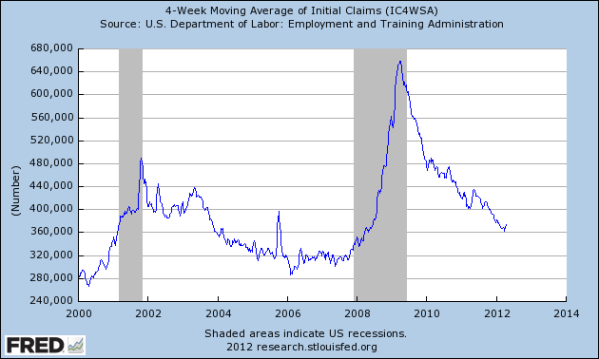

Below is a chart from our old friends at the St Louis Fed with data on Unemployment Initial Claims since 2000. A slightly longer view shows how useful this data still is:

Note that in the official “recession” of 2001 more people were laid off than before, hitting 480k per week. Even in the best of times in the 2000s the level never went below about 300k every week – meaning that in our economy of about 130M jobs about 12% of all jobs are “turned over” every year. It’s this dynamic nature of employment that makes everything so hard to predict.

But also see how the spike in 2008 hit 640k people losing their job every week – double the level of good times – and has not fallen below 360k despite being on a long slide. You can look at the trend as good, but it’s hard to say it’s anywhere good enough.

What we do know is that the economy lately has been creating about 200k net jobs per month, on average, since the end of 2011. That came despite losing about 1,600k jobs, meaning that somewhere every month 1,800k jobs are created – about 1.4% of the labor force are in new jobs in any given month, or about 1 in six workers every year.

That’s a dynamic economy. We can’t be completely sure that this strong job growth is continuing, but it was the trend for a solid 6 months.

That is what makes the Initial Claims number a bit less useful now. Every one of those 360k people will tell you that losing a paycheck is a hardship, but overall we have still have some amazing growth. What keeps that Initial Claims number stubbornly high, though it is falling, is clearly a restructuring as we move ahead to the new economy and leave the old busted one behind.

This is an important point because tackling unemployment is hard enough when 8-10 million people do not have as much work as they want. We also have what is apparently an ongoing loss due to restructuring that is still shaking out and will continue to do so even as new jobs are being created.

Initial Claims data was useful for predicting jobs with “real time” data collected every week only when we were on the downhill slide from 2007-2010 and into the quiescent period of slow growth in 2010-2011. It is now a better measure of the old economy fading away underneath us, a process that is not quite over yet. It may soon get down to the 300k level that approximates stability in the dynamic job market, but for now it is stubbornly higher than it should be at this stage of a “recovery”.

This is simply more evidence that the economic event we are in is not only more severe than anything experienced since WWII, it also has some unusual characteristics. These characteristics are more typical of what we have seen in past eras that were labeled “Depressions”, marked by very significant restructuring.

There is a lot to take in here (as usual) so I have to ask a question: if the economy is that dynamic, creating as you say about 1/6 of the workforce in jobs every year, does that mean that the restructuring will take about 6 years or the time it takes for all the jobs to be turned over? That figure seems really high to me as I don’t know that 1/6 of my friends have new jobs every year but it might be, and I’ll have to think about it.

Anna, I think that’s a two-parter. The first part is the much needed “reality check” that all of this data needs, and I would like to ask everyone if about 1/6 of their friends have a new job every year. I think that’s about right, but my mileage may vary.

The second part is one that I can’t answer, which is that if this is all true how long does it take to restructure the whole economy. What I don’t have here are how many of these positions are actually new – not just someone new filling the same slot. That figure has to be lower by definition. So I’ll think about this some more and search for more data on employment dynamics.

Incidentally, there are some reports on this stuff out there, but I didn’t use them because it takes a year to collect the data and I honestly think we’re in a completely different economy than we were a year ago (the point of this whole post, really). So I’m kind of winging it here trying to create a more real-time employment dynamics concept.

ok if this has to do with the leaving the ‘old busted economy’ behind than how many jobs does it take to make that happen & what makes you think this economy is that different from the old one given that we still consume fossil fuels and do nearly everything the same?

OK, to the last point – the “next economy” is not necessarily what you or I might imagine, and economies transform gradually all the time. The job market in particular is always dynamic.However, the restructuring is especially stark in a recession / depression.

Now, as to the last recession – if you assume that 300k per week initial claims is the “baseline” of a healthy economy (and it’s close) then you can peel this away from the data shown above:

2001 “Recession”:

First above 300k/wk: November 2000

End above 300k/wk: Jan 2006

Total jobs lost net above 300k/wk: 20 million

2007 “Recession”:

First above 300k/wk: May 2006

End above 300k/wk: Nov 2013 (projected from data)

Total jobs lost net above 300k/wk: 40 million

Now, this is not to be taken as some kind of gospel truth, but it seems that the total “restructuring” part is about twice a fairly normal recession. The number is much larger than the net job loss, meaning that over the roughly 7.5 year period we don’t lost ALL the jobs right away – some things keep moving on. But eventually it touches about 30% of all the jobs. If you look at this as approximate I think I would stand by it.

Was that a longer answer than you expected? 🙂

You have made a believer out of me. Things are changing. That can only be for the better at this point. Hope our politicians are watching this.

Thanks. I don’t know that enough people are watching this or even understand why there is a need for a serious restructuring. Remember, the official line among establishment figures (politicos, talking heads, etc) is that this is a “Great Recession” and not a more unusual even like a Depression.

Looks to me like the free market is working almost in spite of government intervention. You had some good ideas but isn’t there a point where its’ best to leave it alone?

An interesting point. I still think the overhead on each job is crushing and that the nature of work as we know it is changing (ie, “The Gig Economy”). We still need to adjust to those realities in policy and how we do things like taxation (that is, what does a W2 really mean anymore?). And we do still have a huge job deficit to make up – those 8-10 million un/under-employed.

But we all know the Free Market(tm) does do its job eventually no matter what, so you do have a point. It’s a question as to how “free” it is.

I do not believe there is a “free market” anymore if there ever really was one. Look at all the money thrown at banks and so on that they are sitting on. Is it like 2 trillion dollars or some insane amount? Maybe a “free market” is a good idea but you can not say we have one now. The 1% got where they are b/c of their influence and they will use it to stay there.

A good point – reforms aimed at improving transparency are ALWAYS good for the economy, as far as I can tell. Yes, it’s about $2T on deposit with the Fed, too. So I think you do have some excellent points, although the market is making its own adjustments.

Pingback: K-Waves | Barataria – The work of Erik Hare

Pingback: GDP: The Bet | Barataria – The work of Erik Hare

Pingback: Energy: Implementation | Barataria – The work of Erik Hare

Pingback: Decisions, Decisions | Barataria – The work of Erik Hare